Kubernetes Rules Everything Around Me, VMworld, Pivotal Container Service

Episode 105 · August 31st, 2017 · 58 mins 20 secs

About this Episode

It’s VMworld this week, so there’s fresh news from the Dell Technologies universe to sort through. VMware releases it’s SDDC on AWS scheme and Pivotal announces its container service/stack, Pivotal Container Service (PKS). We discuss both, including a meandering overview of what PKS is and some theory about what enterprises actually want with all that VMware in public cloud. Also, the tragic story of airline and hotel upgrades, like pearls to tired business travelers.

Misc.

- Australia is bigger than France. Checks out.

- Coté got the SSSS TSA search. What fun!

Now you can buy kubernetes from Dell

- VMware/Pivotal/Google make a kubo distro. Uses BOSH, NSX, and kubo to setup clusters. Will run on vSphere and Google Cloud, promises to work with other Google Cloud services, be continuously updated to be compatible with GCE containers. Also, VMware storage services and comparability with VMware systems management tools.

- El Reg coverage, and also from The New Stack.

- TPM: “The private PKS stack will use vSAN for storage, vRealize Automation for orchestration and governance, vCloud Director for provisioning, and vRealize Operations for monitoring. (So, in theory, one could run the PKS stack on the AWS cloud slices that VMware has partnered with Amazon to create, effectively creating a clone of GKE to run on AWS bare metal iron. . . .)”

- More laundry listing of the parts from Google, that is, Google Cloud services you can use in a PKS environment: BigQuery, Bigtable, Spanner, Storage, SQL, Pub/Sub, Vision API, Speech API, Natural Language API, Translate API.

- A list of capabilities from Cornelia’s(?) talk, and what BOSH does (and, thus, does in k8 management).

- Use it for: “PKS™ is ideal for workloads like Spark and ElasticSearch, and when you need access to infrastructure primitives. Further, use PKS for apps that require specific co-location of container instances, and for those that need multiple port binds.”

- The Pod affinity thing here is for when you want to run multiple things grouped together, like with Spark, Elastic Search, etc. where you the different things go together.

- More value-props’ing:

- i.e., kubernetes on it’s own is hard.

- As Ramji points out, PKS means you’ll get a consistent, standardized kubernetes/container technology across the Dell Technologies portfolio.

- Watters lays it out.

- Positioning: guidance seems to be that PKS is mostly for large organizations, “enterprises.”

- PKS to GA in 2017Q4, pricing then too.

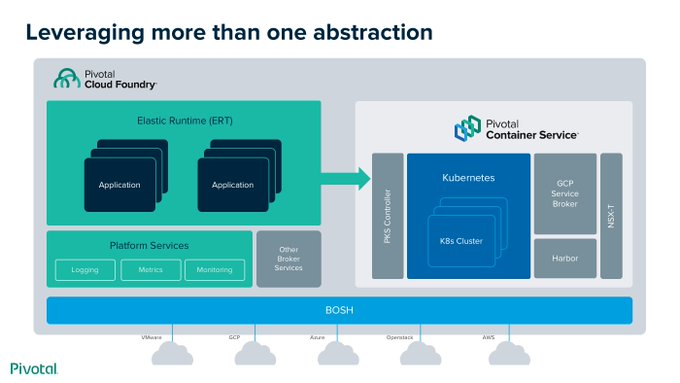

- Diagram here:.

- Some vendor exec story-time here, and Pivotal blog post.

- So, you can run PCF and PKS side-by-side.

- See longer explanation from Chad Sakac:

- “historically, [Dell Technologies’] point of view on the container/cluster manager abstraction ecosystem wasn’t clear”

- See also this pro'er diagram.

- Lots of emphasize on a unified, compatible approach/GTM: “We now have a Cloud Native/Digital Transformation stack where there is a SINGLE target we are furiously running towards now as VMware, Pivotal, and Dell EMC – no mis-alignment, no differences in PoV. “

- “historically, [Dell Technologies’] point of view on the container/cluster manager abstraction ecosystem wasn’t clear”

- Market context:

- You may recall Coté’s summary of the CoreOS commissioned 451 survey, which linked to a 2016(?) Gartner survey where 18% of respondents had containers in production, with 4% being “significant production”

- That CoreOS/451 survey had a very important footnote: the survey respondents were already running containers already. It was more about which container orchestration platforms they liked.

- It was hard to do conclusive ranking of container orchestrators since people were using multiple ones. But, if you lump together CoreOS’s kubernetes distro with generic kubernetes, kubernetes wins out over Docker Swarm, 49% vs. 36%.

- Meanwhile: “By 2020, 50%+ of global enterprises will be running containerized applications in production, up from <20% today.”

- RedMonk’s “developers are the kingmakers” theory, more.

SDDC on VMware

- Run the VMware stack on AWS, out of beta: “For the IT and software development sectors, the deal means that VMware mainstays such as all its software-defined data center ware—vCenter, NSX, vSphere, VSAN and others—will run on AWS instead of VMware's own cloud.”

- Pricing?

- ”The three-year contract costs $109,366 per host, which would save about 50% compared to the on-demand hourly billing rate, according to VMware. Another program can cut costs by up 25% based on their on-premises VMware product licenses, as long as those on-premises products remain active…. There are separate charges for IP and data transfers, as the standard AWS egress fees still apply. Each host has 2 CPUs, 36 cores, 72 hyper-threads, 512 GiB RAM and local flash storage.” - ”the estimated total cost of ownership for VMware Cloud on AWS is up to $0.09 per VM per hour, according to VMware”

- More pricing info from TPM: “The base on demand price for this server is $8.3681 per hour, which works out to around $6,109 per month.”

- Cloud-context, from Derrick Harris: “Look at the companies’ most-recent fiscal years—2016—during which VMware grew about 9 percent to just over $7 billion in revenue, while AWS grew about 45 percent to more than $12.2 billion in revenue. It’s on pace for about $16 billion in revenue in 2017.”

- And, more from Derrick on public cloud companies ever elusive quest to grab on-premises workloads and revenue: “There will continue to be a lot of big workloads running inside company data centers. If AWS and Google really want a shot at owning them, they’ll probably need to get their hands (and code) a little dirty by going to where those applications live and showing there’s a better way of doing things.”

- It makes you wonder if a strategy for public cloud companies going behind-the-firewall is just wishful projection on the on-premise set’s part. 451 surveys a predicting that by 2019, 60% of work-loads will run on cloud technologies (across public, hosted, and private), with under 25% on private cloud (hosted/managed and on-premises).

VMworld, in general

- Round-up of news from Larry Dignan - lot’s of security stuff, of which Coté has no clue. And, of course, the VDI/desktop stuff. It’s like the old Project Octopus era vision of VMware.

- Delving into VMware financials, and some product portfolio strategy typing.

- VIO, VMware’s OpenStack distro has a few production users, but, “for the most part customers are deploying it for their development and test environments, where programmers want to embrace OpenStack and the IT managers want to keep everything on a VMware substrate”

- VIO pricing: “The other thing that is new with VIO 4.0 is that it is no longer free. Starting with this release, VIO will cost $995 per server socket in a Datacenter Edition, but customers who are using VIO in conjunction with the vRealize management suite will be able to get it for $495 per socket. That is just the price of the perpetual license; reckon another 18 percent or so on top of that for annual support.”

- Chad Sakac explains all the stacks, how it does hybrid cloud, etc.

BONUS LINKS! Not covered in show.

SDN

- Turns out, SDN is a condiment, not an entrée.

- Also, a good list of adoption challenges any new technology/thought-technology faces. # Meta, follow-up, etc.

- Patreon - like anyone who starts these things, I have no idea WTF it is, if it’s a good idea, or if I should be ashamed. Need some product/market fit.

- Check out the Software Defined Talk Members Only White-Paper Exiguous podcast over there.

- Join us all in the SDT Slack.

Mid-roll

- Get $50 off Casper mattresses with the code: horraymattray

- Coté’s on the road!

- September 13th - Charlotte Cloud Foundry Meetup, speaking.

- September 18th and 19th - DevOpsDays Riga, Latvia.

- September 21st and 22nd - DevOpsDays Kansas City. Use the code SDT2017 when you register.

- October 3rd and 4th - DevOpsDays Auckland, speaking

- October 17th and 18th - DevOpsDays Nashville, $25 off with the code 2017NashDevOpsDays - Coté will be keynoting.

- October 25h - DC Cloud-Native Meetup, speaking.

- October 26th - FedScoop Digital Transformation Summit, panel.

- November 6th to 10th - Devoxx Belgium.

- December 4th and 5th - SpringOne Platform. Use the code S1P200_Cote for $200 off registration.

- Matt’s on the road!

- September 15-16 - DevOpsDays Bangalore

- September 20 - Azure Sydney Meetup

- October 11th - Brisbane Azure User Group

- November 6-7 - AgileNZ

- I won’t be there, but lots of Chef Summits coming up (Seattle, NYC, London)!

- Andrew Clay Shafer will be at DevOpsDays Singapore (so will Matt) October 25-26, and a few other places. He doesn’t want to make platinum.

Recommendations

- Brandon: The Handmaid's Tale: Special Edition. Coté ads Alias Grace. Coté still doesn’t like Diaspora.

- Matt Ray: Dan Carlin’s Hardcore History “Destroyer of Worlds.”

- Coté: Normal, Warren Ellis. Don’t worry about eating cicada grubs.

Episode Sponsors

-

DevOpsDays DevOpsDays Kansas City 2017 is Sep 21st and 22nd this year. Coté will be speaking, and many other great speakers. Get a special discount when register with the code SDT2017.

-

DevOpsDays DevOpsDays Nashville is October 17th and 18th. Coté will be keynoting. $25 off with the code 2017NashDevOpsDays.

-

Pivotal Come check the success stories in cloud-native at SpringOne Platform. Full of the suits and the nerds going over how they've improved their organization's approach to software. Use the code S1P200_Cote to get $200 off registration!

-

Casper Get a comfortable, well priced Internet mattress, delivered right to your door. Coté has two. And get $50 off your order with the code hooraymattray.